Strong Recommendations About Home Mortgages That Can Aid Anyone

Article created by-Skov HinesWhile everyone considers buying a home at some point in their life, having to get a mortgage to pay for it can seem intimidating. In fact, some people are so worried about the situation that they continue to rent instead. Build https://time.com/nextadvisor/loans/student-loans/what-president-biden-means-for-your-money/ by reading this article and learning about mortgages.

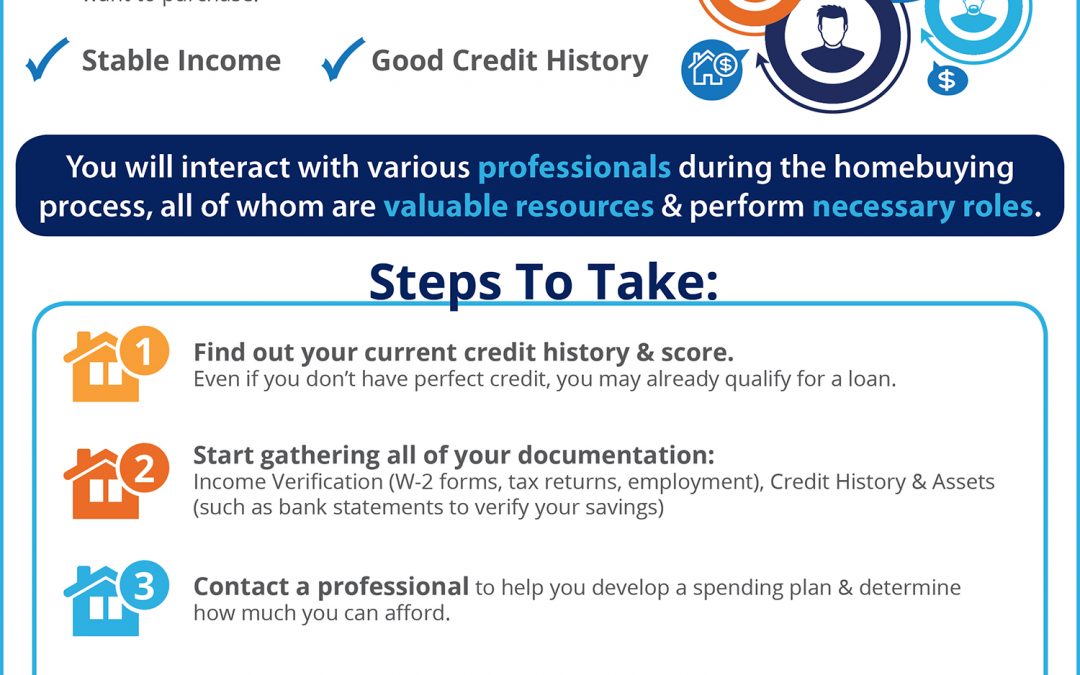

To make sure that you get the best rate on your mortgage, examine your credit rating report carefully. Lenders will make you an offer based on your credit score, so if there are any problems on your credit report, make sure to resolve them before you shop for a mortgage.

Avoid borrowing your maximum amount. A mortgage lender will show you how much you are qualified for, however, these figures are representative of their own internal model, not exactly on how much you can afford to pay back. You need to consider how much you pay for other expenses to determine how comfortably you can live with your mortgage payment.

Prepare your paperwork before applying for a mortgage. There are many items that a lender will require. These items include the last two or three years worth of tax returns, copies of each of your monthly credit card statements and installment loans. Three months bank statements and two months worth of pay stubs are also needed for approval.

A fixed-interest mortgage loan is almost always the best choice for new homeowners. Although most of your payments during the first few years will be heavily applied to the interest, your mortgage payment will remain the same for the life of the loan. Once you have earned equity, you may be able to refinance your loan at a lower interest rate.

Your mortgage payment should not be more than thirty percent of what you make. If you accept a loan for more for that and you find yourself in a tight spot in the future, you can bring about a financial catastrophe. When your payments are manageable, it's much easier to keep a balanced budget.

Predefine terms before your application process, not just to prove to your lender that you are able to handle any arrangements, but also to keep it within your monthly budget, too. This means setting a limit for monthly payments, based on what you can afford and not just what type of house you want. Regardless of a home's beauty, feeling house poor is no way to go through life.

Mortgage rates change frequently, so familiarize yourself with the current rates. You will also want to know what the mortgage rates have been in the recent past. If mortgage rates are rising, you may want to get a loan now rather than later. If the rates are falling, you may decide to wait another month or so before getting your loan.

Draw up a budget before applying for a home loan. It is important that you know how much you can realistically spend on a mortgage payment. If you aren't paying attention to your finances, it is easy to over-estimate how much you can afford to spend. Write down your income and expenses before applying for the mortgage.

If you can afford the higher payments, go for a 15-year mortgage instead of a 30-year mortgage. In the first few years of a 30-year loan, your payment is mainly applied to the interest payments. Very little goes toward your equity. In a 15-year loan, you build up your equity much faster.

When trying to figure out how much of a mortgage payment you can afford every month, do not neglect to factor in all the other costs of owning a home. There will be homeowner's insurance to consider, as well as neighborhood association fees. If get more info have previously rented, you might also be new to covering landscaping and yard care, as well as maintenance costs.

Be sure you have a good amount of money in your saving's account before you try applying for your home's mortgage. You will need to have cash on hand for closing costs, a down payment and such miscellaneous expenses as inspections, application and credit report fees, title searches and appraisals. Having a larger down payment may lead to a mortgage with better terms.

Avoid questionable lenders. While most are legitimate, some will try to take homeowners for a ride, stealing their money and acting unethically. Steer clear of slick lenders who try to persuade you. Don't sign things if you think the rates are just too high. Understand how your credit rating will affect your mortgage loan. Lenders who encourage you to lie about even small things on your application are bad news.

While you are in the process of getting a mortgage loan, do not apply for any new credit cards. Every time your credit is checked it puts a mark on your credit score. Too many of these will make it difficult on you if your credit is already a bit questionable.

Pay off more than your minimum to your home mortgage every month. Even $20 extra each month can help you pay off your mortgage more quickly over time. Plus, it'll mean less interest costs to you over the years too. If you can afford more, then feel free to pay more.

If you have a lot of open credit cards, consider paying them off and closing the accounts before applying for a home loan. Many lenders look negatively upon the overuse of credit. So, by closing your credit card accounts, you can show that you are a worthy credit risk for the lender.

Be sure that you know exactly how long your home mortgage contract will require you to wait before it allows you to refinance. Some contracts will let you within on year, while others may not allow it before five years pass. What you can tolerate depends on many factors, so be sure to keep this tip in mind.

Do not do anything that will raise red flags to the lender while you are waiting for approval. Co-signing on a loan for someone else, changing jobs, moving to a new address or applying for a name change are all things that should never be done until after your loan is closed.

Use what you learned here to get the right mortgage for you. With a little effort, you can find out a lot about the mortgage process. You don't have to feel frustrated with the options that are out there. Rather, let the knowledge be your road map to mortgage success.